Mutual Funds

Mutual Funds are pooled investment vehicles managed by professional fund managers. They enable investors to access a diversified portfolio of stocks, bonds, or other securities with ease. By combining resources from many investors, mutual funds lower costs, offer liquidity, and provide options for different risk profiles and financial goals, all without the need to manage individual investments.

Advantages:

- Low Entry Barrier: Start investing with as little as ₹500

- Diversification: Reduces risk by spreading investment across assets

- Professional Management: Managed by qualified fund experts

- Liquidity: Easy to buy and redeem your units

- Tax Benefits: Under ELSS category (Equity Linked Saving Schemes)

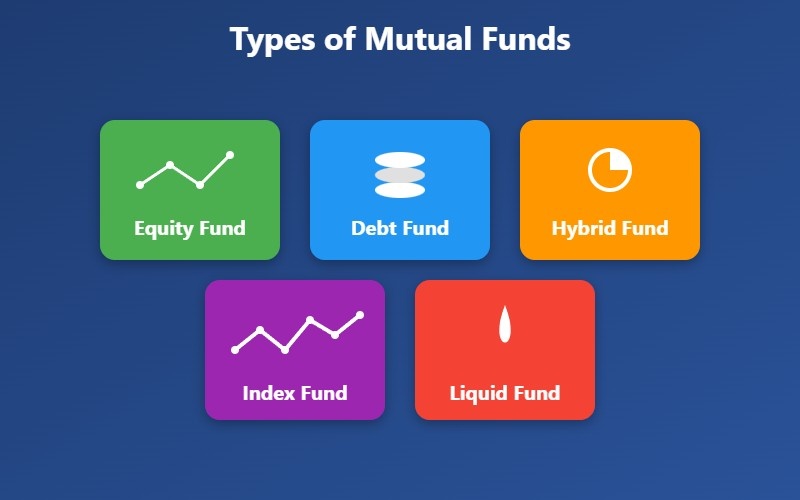

Types of Mutual Funds:

- Equity Mutual Funds: For long-term capital growth

- Debt Mutual Funds: For stable and fixed income

- Hybrid Funds: Combination of equity and debt for balanced risk

- ELSS Funds: Tax-saving mutual funds with a lock-in period

Best For: Investors looking for simplicity, low risk and steady returns.